Aeroflot:

State resumes control

April 2017

On the face of it 2016 was a superb year for Aeroflot, with significant increases in revenue and profits. But it was also the year that Aeroflot reverted to being close to a state monopoly, with all that implies for corporate strategy

In calendar 2016, under IFRS standards, Aeroflot group saw revenue increase by 19.9% to ₽495.9bn (US$7.4bn), thanks to a combination of traffic growth (passengers carried rose 10.3% to 43.4m), efforts to increase yield and the continuing devaluation of the rouble. With further cost control efforts, Aeroflot’s operating profit rose 43.4% to ₽63.3bn ($949m) and a net loss of ₽6.5bn in 2015 turned into a net profit of ₽38.8bn ($583m) in 2014.

The Aeroflot group’s debt position has improved significantly in the last 12 months — total debt fell by 38.4% in 2016 to stand at ₽143.9bn ($2.2bn) at as December 31st 2016, while cash and short-term investments rose 3.2% to ₽37.8bn ($567m). However, this was due partly to the continuing devaluation of the rouble, the sale of nine aircraft and a revaluation of finance lease obligations; and net debt still stood at a not inconsiderable ₽106.1bn ($1.6bn) at the end of 2016.

Transaero effect

The airline’s 2016 results were boosted by the demise of Transaero Airlines, the second largest airline in Russia. The government-mandated merger (see Aviation Strategy, September 2015) between Aeroflot and Moscow-based Transaero in 2015 failed to materialise, and Transaero ceased operation in late October of the same year, instantly taking out a carrier that accounted for around 11% of the total domestic and international market in Russia.

Aeroflot was obliged to step in anyway, financing the carrying of 1.8m passengers on “Transaero” flights through the rest of the year, while transferring another 0.2m passengers onto its own equipment and fully refunding all others that couldn’t be accommodated on those flights. In total, support to Transaero passengers cost Aeroflot some ₽16.8bn (US$277m), and there have been other adverse impacts of the bailout, such as provisions for Aeroflot group loans to Transaero. In addition, the Aeroflot group hired more than 4,250 ex-Transaero employees and took over 30 aircraft from the former Transaero fleet, including 10 737s and six A321s that were on outstanding order at the time the carrier collapsed.

While that was the short term price to pay, the longer term result for Aeroflot is a lot better than if it had been forced to swallow the whole of Transaero, as the government wanted back in 2015. Instead, Aeroflot has been able to cherry-pick the best of the former Transaero routes; it has taken over (or plans to take over) 56 of the 141 international routes previously operated by Transaero — although of course the ability to take over Transaero slots at international airports is not as easy as it is in Russia, where the government rubber stamps anything Aeroflot wants. Indeed, rights for 13 Transaero routes were returned by Aeroflot to the Russian aviation authorities voluntarily, while seven destinations were not extended after one year of operation.

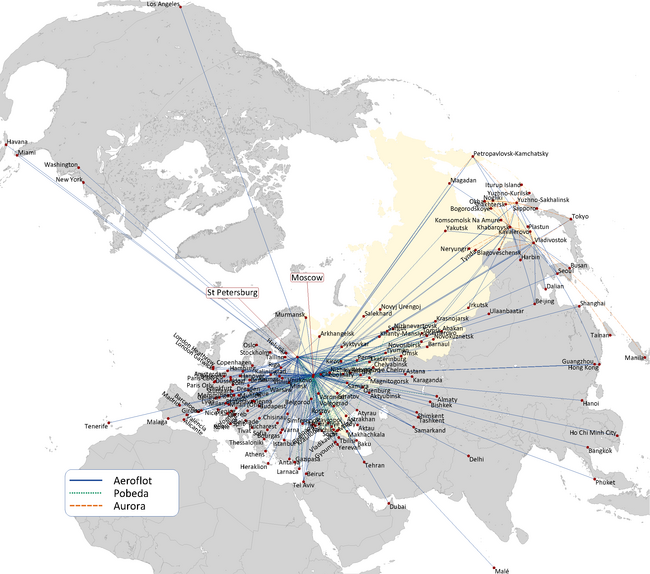

The Aeroflot group currently operates to more than 150 destinations in 51 countries. It follows a confusing multi-brand strategy, largely as a result of the variety government-mandated domestic mergers and acquisitions it has had to swallow. The mainline Aeroflot is the country’s flag carrier and operates a hub-and-spoke operation out of Moscow Sheremetyevo, which accounts for around two-thirds of all passengers carried by the group (29m passengers in 2016, 11% up year-on-year).

Somewhat obstinately, Aeroflot is still attempting to develop Moscow as a transit point for passenger flows between the Asia/Pacific region and Europe/North America, though — frankly — this is a tough sell to passengers, many of whom would prefer to transit anywhere other than Russia. Indeed international-international transit passengers for the group fell from 9.1% in 2015 to 8.5% in 2016, and at Sheremetyevo airport the proportion of Aeroflot traffic that was transit fell from 44.2% in 2015 to 42.1% in 2016 (with international-international transit traffic falling from 14.0% to 13.1%).

Next in the group portfolio is — in its own words — “middle-price” Rossiya, which is based in Pulkova (Saint Petersburg) and operates on domestic, regional flights and a handful of international routes out of Pulkova and Vnukovo airport in Moscow. Last year Rossiya absorbed the group’s Donavia and Orenair airlines, and today it operates 67 aircraft, carrying 8.8m passengers in 2016 (2.8% down on 2015).

Not part of Rossiya (as yet) is Aurora, a regional airline in the far east of Russia that operates 23 aircraft domestically and to some international destinations out of the remote airports of Vladivostok, Khabarovsk and Yuzhno-Sakhalinsk. It carried 1.4m passengers last year, compared with 1.1m in 2015. Aeroflot owns 51% of Aurora, but it makes little sense not to incorporate it into the Rossiya operation; indeed there is a strong argument that Rossiya itself is a brand too many for the Aeroflot group, where operations, management and marketing would probably be much simpler were it to consist of solely the mainline Aeroflot brand and an LCC operation.

That LCC operation is Pobeda (which means 'victory' in Russian), the group’s latest attempt at the low cost segment and which operates 12 737-800s (all leased) out of Moscow Vnukovo on 36 routes — mostly domestic, although it does operate to eight international destinations. It carried 4.3m passengers in 2016, a 39% increase on the year before, and follows a standard LCC business model with paid-for meals, fees for carry-on luggage and tickets sold primarily through direct channels.

The total Aeroflot group fleet comprises 291 aircraft, 44 more than 12 months ago (see chart), as the airline continues to expand and modernise its fleet from the assorted rag-bag of types it used to have into a young, western-built fleet — the last six An-148s have now been phased out through a sublease. The total group fleet has an average age of 6.5 years — slightly higher than at the end of 2015 — but that is still impressive, and the mainline’s average of 4.2 years is better than almost any other full-service rival.

On outstanding order for the group are 35 aircraft, comprising 14 A350s and one 777. At the end of last year it cancelled 8 of its original order for 22 A350s, and transferred its order with Boeing for 22 787s to Avia Capital Service — the leasing subsidiary of state-owned conglomerate Rostec from which Aeroflot has a contract to lease 50 737NGs. Its medium term fleet plan (see table) show it acquiring a net 68 new aircraft over the next two years including two 747-400s for long-haul, and 37 737s, 21 A320s and 13 A321s. In addition, Aeroflot has another 20 SSJ-100s due to be delivered this year and next (and yet another example of state interference).

State control

The state agency Rosimushchestvo owns 51.17% and Rostec, a state conglomerate, has a further 3.3%. There is a free float of about 41% of the shareholding, but the reality is that strategic decisions are made by the state, and this effectively means that Aeroflot has little — if any — chance of transforming itself into a truly modern airline that is flexible enough to instantly take advantage of new market opportunities as they crop up.

Not that there are many of these at the moment, as the Russian economy is still in deep trouble. GDP growth fell steadily from 2010 to 2014, plunging to a 3.7% GDP contraction in 2015 and followed by another 0.7% GDP shrinkage in 2016. There are many reasons for this deep recession but falling oil prices have been exacerbated by US and EU sanctions over Russia’s illegal interference in the Ukraine/Crimea, carried out partly by President Putin to divert attention domestically from increasing economic woes. The most significant effect on Aeroflot (and all Russian airlines) is that the value of the Rouble fell by almost 60% in just two years, from a rate of 33 Roubles to the US Dollar at the start of 2014 to 84 Roubles exactly two years later. Of course that significantly increases costs incurred abroad in Rouble terms. The good news is that the currency has recovered partially since that huge devaluation, to approximately 59 Roubles to the Dollar as at mid-March 2017, and there is hope of returning to GDP growth this year — though Putin would be unwise to assume that a “Russian-friendly” President Trump will substantially reduce sanctions anytime soon, especially after events in Syria.

Long term goals

The Aeroflot group has four strategic goals for 2025, a date that is such a long way away (maybe on purpose) it is very difficult to pass considered judgment on how well the airline is doing in getting there.

-

To become a top five European and top 20 global airline in terms of passengers carried, with more than 40m international passengers and 30m domestic passengers carried a year by 2025. The group carried 18.2m international and 25.2m domestic passengers in 2016, so from that it needs just an average annual growth of 2% domestically from now until 2025 — but for international it needs a CAGR of 9.2% for nine consecutive years, which could prove difficult to achieve.

Overall the group has 44.7% share of the domestic market and a 39.4% share of the international market to-from Russia last year. That compares very well with the respective market shares of 20.6% domestically and 18.9% internationally it had back in 2009, and Aeroflot’s domestic share has risen consistently over the last few years thanks to government-mandated domestic consolidation, development of the LCC market and a decline in “long-haul” domestic rail passengers as train fares have risen. However, yield is clearly higher on international routes (by around 20%), and the critical problem that Aeroflot faces is that the international market continues to shrink — which the airline says is due to “continuing pressure on consumer confidence” — another way of saying international travel has been hit hard by precarious domestic economy as well as international sanctions to punish Putin for his imperial ambitions in Ukraine. In fact the total number of international passengers to/from Russia has fallen from 65.5m in 2014 to 46.4m — a calamitous drop of almost 30%. This means it will be extremely difficult for Aeroflot to hit its 2025 international target unless either the market grows very fast (unlikely) or the Russian flag carrier can effectively double its market share (extremely unlikely).

- To become a top five European and top 20 global airline in terms of revenue. As of 2015 Aeroflot claims to be the seventh highest revenue airline in Europe and 23rd in the world, but most analysts would say this goal is irrelevant; what counts is profitability and cash generation — measures that are noticeably absent from Aeroflot’s grand strategic vision.

- Development of the hub-and-spoke model, with an explicit goal by 2025 to have a 32% share of transit passengers among total group passengers carried. The problem is that, given very strong growth for LCC Pobeda, the percentage of transit passengers in the group is actually falling, not rising — the proportion of transit passengers fell from 28.7% in 2015 to 27.5% in 2016. It would be madness for the group to restrict the growth of its LCC, and so the only way it will be able to increase its transit proportion to 32% by 2025 is to significantly increase transit passengers at the mainline at Moscow, which is a very tough ask indeed.

- Increasing presence in various geographical and price segments. This is a vague, general statement and is the only one of its four strategic goals without any specific KPI target.

Despite the negatives, Aeroflot’s share price has quadrupled since 2015 giving it a market capitalisation of $3.5bn and a historic PER of 5x. Investors appear to have taken the view that the benefits of consolidation of the Russian airline industry outweigh political interference and international sanctions.

| Total | 291 | (35) | 325 | 353 | 328 | 312 | |

| 2016 | 2017 | 2018 | 2019 | 2020 | |||

|---|---|---|---|---|---|---|---|

| Aeroflot | Subsidiaries | Orders | |||||

| A319 | 36 | 33 | 26 | 18 | 15 | ||

| A320 | 70 | 5 | 79 | 80 | 69 | 59 | |

| A321 | 32 | 39 | 43 | 41 | 41 | ||

| A330 | 22 | 22 | 22 | 19 | 15 | ||

| A350 | (14) | 5 | 8 | 10 | |||

| 737-800 | 20 | 29 | 68 | 80 | 79 | 79 | |

| 747-400 | 7 | 9 | 9 | 9 | 9 | ||

| 777-2/300 | 15 | 6 | (1) | 21 | 26 | 26 | 26 |

| SJ100 | 30 | (20) | 42 | 50 | 50 | 50 | |

| An-148 | 6 | ||||||

| DHC-8 | 11 | 10 | 10 | 7 | 6 | ||

| DHC-6 | 2 | 2 | 2 | 2 | 2 | ||

| 189 | 102 | ||||||

Source: Company reports, Boeing, Airbus. Notes: plan in according with existing contracts. Excludes one An-24.