Argentina: La Revolución

de los Aviones

December 2017

The Argentine aviation market is poised for a disruption and massive growth in the next couple of years as numerous airlines, including at least two high-profile LCC entrants, prepare to launch or expand service in 2018.

Airlines are taking advantage of an unprecedented opportunity resulting from Argentina’s economic recovery and new market-friendly policies introduced by President Mauricio Macri since he took office in December 2015.

In the aviation sector, the Macri administration is eliminating subsidies to state-owned Aerolíneas Argentinas, allowing competition on both domestic and international routes, relaxing controls on domestic fares and investing in aviation infrastructure. At an ALTA conference in November, Argentina’s transport minister Guillermo Dietrich said that the government saw the aviation sector as one of the engines to eradicate poverty because it “connects our country and generates opportunities”.

Currently Argentina’s domestic market is dominated by Aerolíneas and its sister company Austral, which account for 72% of the total flights, with LATAM Argentina having a 15% share (November 2017 figures). On the international side, Aerolíneas and LATAM are pretty much the only Argentine operators.

But the past policies of prioritising Aerolíneas and local bus companies, which Dietrich described as “errors made by our country”, have given way to promoting competition in the aviation sector.

The past year’s massive route awards are indicative of the new thinking. Argentina’s CAA held public hearings in December 2016 and September 2017, in which airlines requested new routes to operate scheduled services. Subsequently the Air Transport Advisory Board (JATA) recommended the granting of 635-plus new scheduled domestic or international routes to 11 existing or planned airlines. Aerolíneas, Austral and LATAM Argentina were excluded from those proceedings.

The tentative route awards, which were conditional on the final approval of the Ministry of Transportation, were given for 15-year periods. They are subject to airport capacity and facilities being available and, in the case of international routes, bilateral agreements allowing additional services and operators. But the government is obviously keen to negotiate new and expand existing bilaterals.

The five airlines that presented in the first hearing (Flybondi, Andes Lineas Aéreas, American Jet, Alas del Sur and Avianca Argentina) had all secured final approvals from the Ministry by the end of June 2017. Some from the September hearing may still be awaiting final authorisation; that group included Just Flight, Buenos Aires International Airlines, Grupo Lasa, Norwegian Air Argentina, Polar Lineas Aéreas and Servicios Aéreos Patagónicos (SAPSA) — plus Avianca Argentina, which came back to request more routes.

Of the 11 airlines, so far only two — Andes and Avianca Argentina — have begun operating the awarded routes. But there could be a scramble in 2018 because in mid-December the government published a decree requiring all new entrants to obtain AOCs and other necessary certificates within 12 months of receiving their route awards.

Some of the proposed airlines in very early planning stages or with questionable business plans may not be able to raise the funding, round up the aircraft or complete other necessary steps to secure AOCs in time. Others may not meet (possible) deadlines for launching flights after obtaining AOCs.

Those that make it to the air will find that Argentina poses more than the usual amount of challenges and risks for new airline entrants. Will the government abolish the minimum domestic fare requirements so that new entrants like Flybondi can offer ULCC-type fares? Will a market-friendly, pro-aviation government remain in power? Will there be sufficient infrastructure to handle all the growth? Could Argentina’s powerful labour unions block the path for LCCs?

There is tremendous interest in getting into the Argentine aviation market because of its enormous potential. Argentina is one of the biggest untapped domestic airline markets in the world. Flybondi investor Michael Cawley (ex-Ryanair COO) recently described it as an “incredible opportunity”, one that is “much better than Ryanair ever encountered in Europe”. Flybondi believes that total passengers in Argentina (domestic and international) could quadruple to 80m in ten years.

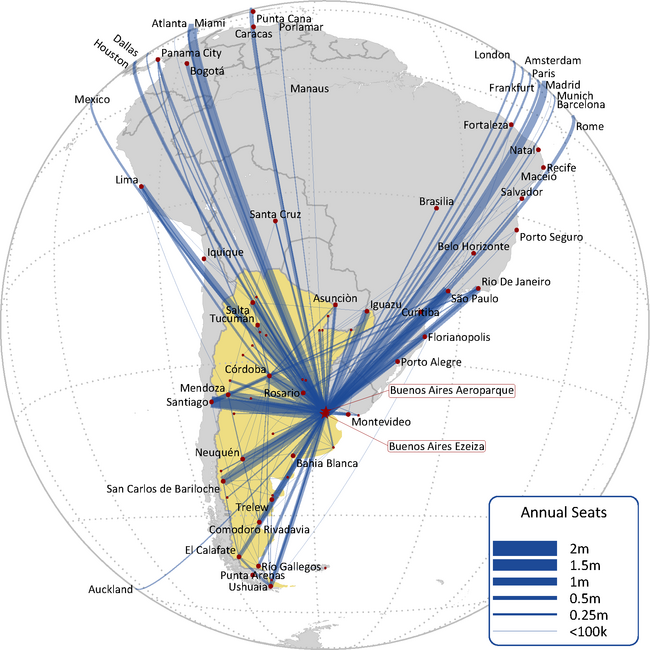

Argentina’s potential has also captured much interest from foreign operators, and the government is being equally generous with route awards on that front.

Among the numerous foreign airlines that have grown their operations to Argentina, 2017’s most noteworthy new entrants were IAG’s long-haul low-cost unit Level and Brazil’s Azul. Level added Barcelona-Ezeiza flights with A330-200s, while Azul introduced Belo Horizonte-Buenos Aires flights with E195s and A320neos.

This year’s highlight will be the start of Norwegian Air Shuttle’s flights to Argentina from Europe, representing the European LCC’s entry to the South Atlantic. NAS is inaugurating four-per-week London Gatwick-Buenos Aires services in mid-February, ahead of the Argentine subsidiary’s launch in the summer.

Notably, many of the new services added by airlines from other South American countries are to secondary cities in Argentina, such as Córdoba, Bariloche, Mendoza, Rosario, Neuquén, San Juan, Tucuman and Salta. The Argentine government is keen to improve air connectivity from the interior of the country.

Flood of new entrants

The 11 companies vying for position in the Argentine scheduled passenger market fall into four broad types. First, there are the LCC heavyweights — Flybondi and Norwegian Air Argentina — that have global investors, strong funding and solid business plans. Those two airlines’ low fares and planned scale of operations could have enormous impact in terms of stimulating air travel in Argentina and capturing market share from Aerolíneas.

Flybondi, Argentina’s first ULCC, expects to begin operations in January, having received its first leased 737-800 in early December. It will start with two or three domestic routes from its Córdoba base and will use its second aircraft to launch flights from Buenos Aires El Palomar later in the first quarter. The goal is to serve the 85 routes that it has been licenced for (43 domestic and 42 international intra-Latin America) by 2021, utilising a fleet of 28 aircraft.

Flybondi has shelved plans to order the 737 MAX 200 at this stage, instead deciding to grow the fleet to 10 or so leased 737s by the end of 2018. The company has prominent local and international investors (for the background, see Aviation Strategy October 2016). This year’s highlights included completing a new $75m financing round, led by the US private equity firm Cartesian Capital Group. Flybondi could over time really disrupt the market with ULCC-type fares.

Norwegian Air Argentina (NAA) is looking to launch low-cost domestic flights by June 2018. The airline received final authorisation in early December to operate 152 domestic and international routes. Its first 737-800 is due to begin the certification process in January, and the airline sees operating 10-16 aircraft in its initial year and eventually growing the fleet to 70 aircraft (737-800s and 787-9s). A321LRs and 737 MAXs are also a possibility, since all of NAA’s aircraft will come from parent company Norwegian Air Shuttle’s existing orderbook.

With plans to operate four major hubs in Argentina, fly all around the world from each of those hubs and serve many destinations in the US, NAA is potentially a serious disruptor in Argentina.

Second, there are the established Argentine executive jet and/or charter operators that are now moving to start scheduled service and operate larger aircraft. While not disruptors, they will make a contribution in terms of improving connectivity and growing the market. They benefit from knowing the Argentine market, having facilities in place, etc.

The most prominent airline in that category is Synergy Group’s Avianca Argentina, which previously operated executive jets as Macair Jet. The rebranded carrier launched operations in late November 2017 and has ambitious plans to grow in the domestic and intra-Latin America international markets with ATR 72-600s and later also A320s.

Another example is Andes, an established Salta-based charter airline that already operated MD-83s. Andes began adding scheduled service last summer after receiving route awards and its first used 737-800 (now at least eight in the fleet).

There is Just Flight, a 24-year-old Buenos Aires-based air taxi company that now wants to diversify to 20-seat Fairchild C-26 Metro IIIs. The airline has secured ten scheduled routes, including one to Uruguay.

American Jet, an old-established Patagonia-based company that operates charters, corporate flights and medical care flights with a diverse fleet that includes ATR 42-320s, is looking to start scheduled flights but has not yet made its plans public.

SAPSA (Servicios Aéreos Patagónicos), a well-established charter operator, has secured 40 scheduled routes, mostly from Buenos Aires but some also from secondary cities. The plan is to initially deploy CRJ200s domestically. The route awards also include Ft. Lauderdale, Orlando, Lisbon, Paris and Frankfurt, to be served at a later stage. SAPSA may be a serious contender because it is part of (and funded by) the Via Bariloche tourist group, which also provides ground transport. The plan is to achieve integrated air-ground operations.

Third, there is at least one proposal for a promising new niche carrier. LASA Lineas Aéreas is looking to operate five scheduled routes in the Patagonia region utilising ERJ145LRs, with hubs at Neuquén and Comodoro Rivadavia. The “purely touristy” routes will include Chilean Patagonia. LASA has already received $10m of its planned $73m total funding from Argentine investors. It had a website running in mid-December but was not yet selling tickets.

Fourth, the public hearings heard presentations from three proposed airlines that have big global ambitions but seem to be at a relatively early stage of development, with little evidence of funding, making it uncertain if they will take off.

Buenos Aires International Airlines has tentatively secured a whopping 178 domestic and international routes, including 15 to North America and 25 to Europe. It also has plans to operate some unusual routes from Buenos Aires, including Singapore via South Africa, Hawaii via Los Angeles, Beijing via London, Tokyo via Auckland and Shanghai via Zurich. The airline wants numerous destinations but would operate very low-frequency, charter-type services at least in the long-haul markets. The main hub would be at Buenos Aires Ezeiza and a secondary hub at Córdoba. Initial fleet for domestic and intra-Latin America operations would consist of 737s.

The September hearing heard little about ownership or funding plans, but former executives from defunct Southern Winds are believed to be involved (an Argentine airline that ceased operations in 2005). The filings suggested that the founders are being advised by and may get finance from Seabury Capital.

Polar Lineas Aéreas is another proposed new entrant with ambitious plans. It has been awarded 44 domestic and 31 international routes for passenger services, plus some cargo routes. It plans to operate domestic services from seven cities in Argentina, initially with E190s and later also with A320-200s. Polar would also operate to Brazil, Bolivia, Chile, Peru and Colombia. In the longer run it would also deploy large aircraft and serve Auckland, Sydney, Madrid and Miami.

Polar is reportedly the brainchild of Ricardo Barbosa, former owner of CATA (an airline that operated in 1986-2006). Some reports in October talked of a December start, but the company does not yet even have a website running.

Alas del Sur, which presented in the December 2016 hearing and secured route awards in March 2017, plans a Córdoba base and a secondary hub at Ezeiza, from which it will operate domestic and intra-Latin America international services with A320s. Later it will add long-haul services to Barcelona, Shanghai, Fuzhou and Miami with 777s.

However, Alas del Sur seems to be experiencing delays and its website is looking oddly out of date. The site lists a year-end 2017 fleet of three A320s and three 777s, but in reality the company has not yet received any aircraft.

Pro-aviation policies

In its first two years the Macri administration has accomplished much in opening Argentina to the world after years of protectionism. Market-friendly reforms, currency devaluation and other measures have already attracted substantial foreign investment. Argentina is again selling bonds in the global markets and has raised significant funds from international agencies.

Macri’s Cambiemos coalition received a vote of confidence in October’s mid-term elections, strengthening its mandate to pursue reforms. As Fitch noted, the structural reform agenda includes “easing the onerous tax burden, improving labour market flexibility, reducing subsidies and deepening shallow capital markets”.

After average real GDP growth of negative 0.1% in 2012-2016, including a 2.2% decline in 2016, Fitch expects Argentina’s GDP to expand by 2.8% in 2017 and 3.4% in 2018. This could mark the start of a more stable growth pattern. Inflation, while still high, is expected to ease in 2018.

One of Macri’s immediate aviation-related actions was to order the phasing out of state subsidies to Aerolíneas and appoint a new CEO from the private sector (who resigned after less than a year and was replaced by Mario Dell’Acqua, ex-head of the state-run logistics company Intercargo).

Since then Aerolíneas has seen a sharp reduction in subsidies, which are expected to be eliminated altogether by 2020. The airline is trying to improve efficiency through fleet renewal and aircraft upgauging. It has restructured its Aeroparque hub and is pulling out of markets such as Barcelona after Level’s entry made the route unprofitable. Aerolíneas plans to counter the LCC entrants’ low fares through better fare segmentation.

Macri has also reduced government regulation of air fares. As the first step, controls on maximum domestic air fares were abolished in February 2016. However, minimum prices remain and could hinder the progress of ULCC entrants like Flybondi, which has frequently said that it could offer tickets at half the minimum prices.

Opinion is divided on how soon the minimum prices will be abolished. A year ago it was thought to be imminent, but reports from November’s ALTA conference suggested that there might be a further delay. The head of the CAA reportedly commented that he thought the price floors, which had been originally introduced to protect long-haul bus operators, had limited impact on airlines.

Flybondi’s CEO Julian Cook has said in the past that in the short term the airline could get around the restrictions, for example, by setting up a members-only club or offering free hotel rooms. So perhaps the government will turn a blind eye to airlines being creative. But realistically, to make the ULCC business model work Flybondi needs the flexibility to offer $10-type fares in certain time periods and for special promotions.

Importantly, the Argentine government is making progress in improving aviation infrastructure. In September 2016 it announced plans to invest $1.4bn to upgrade infrastructure at 19 airports and introduce new air navigation technology (the ORSNA 2016-2019 plan). According to a government website, after 15 months work has been completed at nearly half of the airports. The timing of the completion of the remaining projects will to a certain extent determine the order in which airlines launch their planned routes.

Also, Dietrich confirmed in November that the government is building a “completely new low-cost airport” at the El Palomar air force base just 20km from Buenos Aires. Using El Palomar was originally Flybondi’s idea and the airline was awarded 56 routes from there, but there has been strong local opposition. According to Flybondi, El Palomar will set up a temporary structure to enable it to start operating from there in the first half of 2018 while talks continue on building a proper terminal.

All of that is part of the government’s “La Revolución de los Aviones” plan that aims to double the number of Argentinians that travel by air, generate investment and quality employment and boost tourism and regional economies. The government projects that domestic passengers in Argentina will more than double over four years, from 10.5m in 2015 to 22m in 2019.

The long-term potential is clearly there. Argentina is Latin America’s third largest economy, with a population of 44m and a vast territory. Similar to Brazil and Mexico when the LCCs arrived, most people rely on long-haul buses for domestic travel. Argentina has the fewest flights per capita among South American countries.

But challenges remain. While commending the government’s efforts, IATA continues to stress that more needs to be done to address infrastructure concerns and that Argentina remains over-regulated and over-taxed, with some of the highest passenger fees in Latin America.

High cost levels in Argentina — by some estimates 50%-plus higher than Brazil’s and Chile’s — will be another challenge for LCCs. A late 2016 Oxford Economics/IATA study recommended, among other things, that the government takes a look at monopolistic practices, such as ground handling. More than 30 airports are operated by the same concessionaire, Aeropuertos Argentina 2000.

Argentina’s labour unions are among the most militant in the world. There have been frequent strikes to protest at Macri’s austerity measures and the cost cuts at Aerolíneas. The prospect of LCCs in Argentina has generated mass protests from airline unions.

Interestingly, Indigo Partners’ Bill Franke recently cited “clear regulations” as one of the reasons he chose Chile over Argentina for his latest LCC venture (JetSmart). He observed that although Argentina is a “nice market”, it is “more complicated than Chile”.

Note: Scheduled domestic and international passengers carried by Argentina-registered carriers. Source: World Bank/ICAO

Notes: 2017 estimate based on January-November figures. November 2017 figures are preliminary. Source: EANA (Navegación Aérea Argentina)

Note: † Currently only one route among the top 20 that bypass Buenos Aires.

Source: EANA (Empresa Argentina de Navegación Aérea)

Note: † Currently only two routes among the top 20 that bypass Buenos Aires.

Source: EANA (Empresa Argentina de Navegación Aérea)

Note: † The two main airports serving Buenos Aires

Source: EANA (Empresa Argentina de Navegación Aérea)

Source: Schedules data 2017

Note: Number of flights November 2017

Source: EANA (Empresa Argentina de Navegación Aérea)